Fueling Purpose with Digital ₿ Energy

PhilanthroBit is a North American social enterprise operating in the U.S. and Canada, helping mission-driven organizations leverage technology and alternative funding strategies that drive sustainable growth and impact.

Choose Your Path

Whether you're seeking support for your organization, looking to make a social impact through investment, or a government agency driving regional economic development, we have a specialized pathway for you.

Purpose-led Ventures

Nonprofits and social enterprises looking to leverage alternative funding such as Community Bonds and digital assets for sustainable growth and increased impact.

- Strategic consulting and implementation

- Digital Community Bonds

- Bitcoin & digital asset integration

- Access to our knowledge hub and tools

- Ongoing perks and support with paid Membership

Impact Investors

Philanthropists and investors looking to support our mission of building a community impact investment ecosystem.

- Donate to PhilanthroBit or Invest in our upcoming Community Impact Fund

- Earn by co-investing in Members' Community Bonds

- Create meaningful and lasting social impact

- Access to exclusive investment opportunities and events

- Gain other perks and benefits with paid Membership

Policy & Economic Leaders

Government agencies and economic development organizations seeking to leverage Bitcoin and digital assets to drive regional growth and innovation. Actively collaborating with U.S. government entities and regional EDOs to deploy Bitcoin-first industrial frameworks.

- Bitcoin industry training & workshops

- Strategic economic development advisory

- Digital asset policy & landscape mastery

- Support to attract Bitcoin companies to your region

- Future-proofing for the decentralized economy

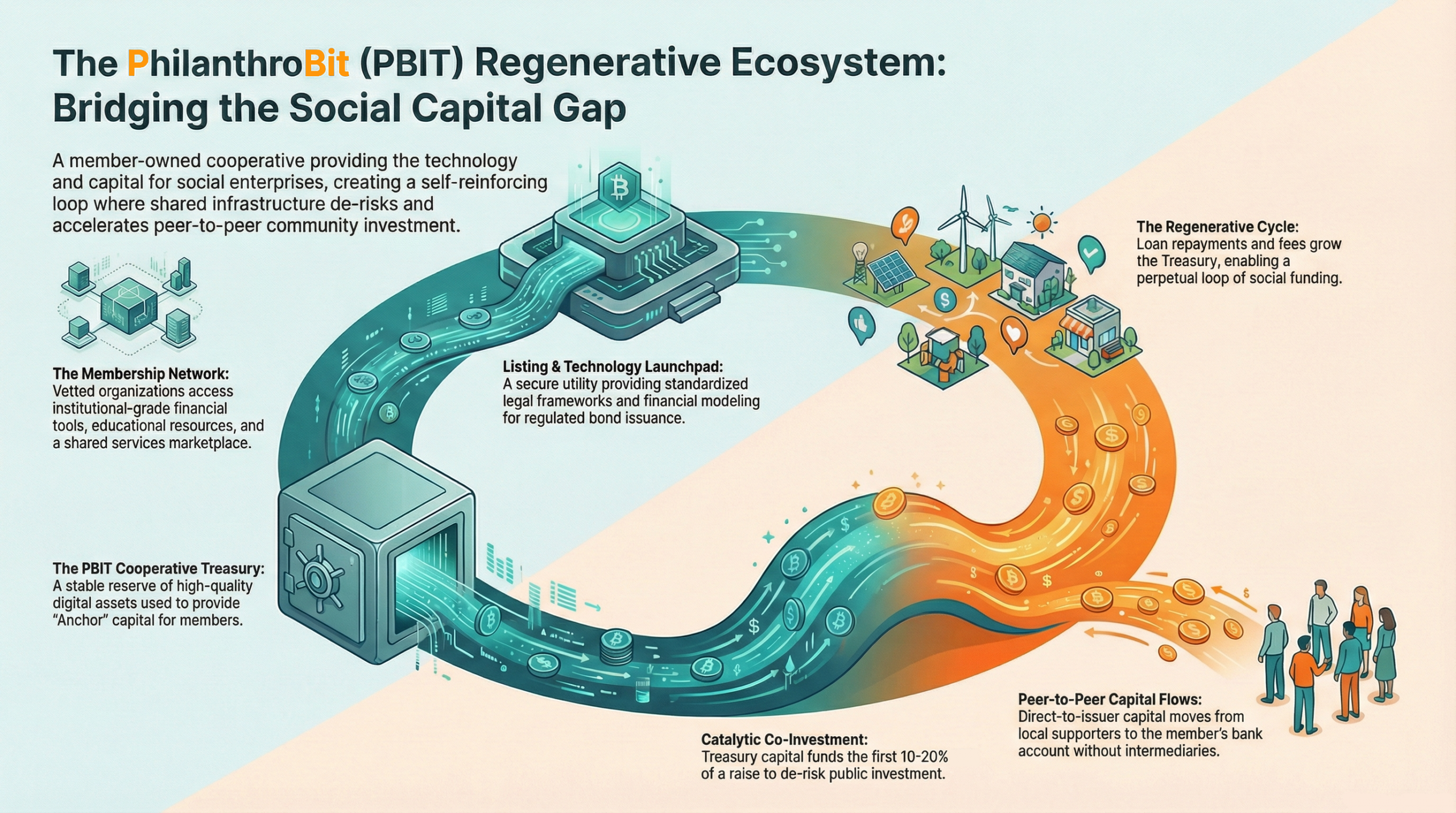

Our Ecosystem

Connecting capital, expertise, and technology to maximize social and environmental impact.

Social Enterprise & Nonprofit Scaling

We provide expert support for planning and scaling social enterprises and nonprofits.

Our Services Build Resilience Through:

- Organizational Consulting: Strategy for operational strength and stability.

- Alternative Capital: Ethical integration of Bitcoin and digital assets.

- Impact Storytelling: Communicating measurable impact to secure social investment.

Strategic Digital Asset Consulting

We deliver expert training and consulting to government and economic organizations focused on strategic digital asset integration.

We empower your team to:

- Master the policy and financial landscape of digital assets.

- Attract and support Bitcoin companies into your region.

- Future-proof your region for the decentralized and digital asset economy.

- Leverage Bitcoin and digital assets technology for strategic advantage.

PhilanthroBit Community Impact Fund

A U.S.-based evergreen fund backed by PhilanthroBit's bitcoin reserves to build long-term community value.

As a Public Benefit social enterprise, a significant share of our profits seeds this Fund and strengthens our impact investing ecosystem.

Our strategy is co-investment: pooling capital with members to back their organizations and community bonds that deliver measurable social and environmental results.

Free Resources

Discover proven strategies in our entrepreneurship guides, understand Bitcoin industry trends, and make better decisions with our business tools and investment calculators.

Knowledge Hub

Practical guides for social impact organizations and the latest Bitcoin & digital asset news.

Browse Articles

Tools & Resources

Interactive Bitcoin calculators, educational quizzes, and business planning resources.

Explore ToolsJoin Our Mission

Whether you need our services or want to support our ecosystem, we'd love to connect with you.

Support Our Mission

PhilanthroBit is a membership-based community investment ecosystem connecting philanthropists, nonprofits, and social enterprises to turn bold ideas into sustainable change with access to alternative, Bitcoin-enhanced funding pathways.

Your donations help seed PhilanthroBit's Community Impact Fund, a social purpose/Public Benefit pool that co-invests in our members’ projects and community bonds to grow resilient organizations and stronger local communities.

Bitcoin (BTC)

Ethereum & EVM

Have a Coinbase account? Donate directly using our Coinbase ID: PhilanthroBit.cb.id